Why Financing Your Airbnb in Nashville Requires a Strategic Approach

Nashville, Tennessee, has become one of the nation’s hottest markets for short-term rentals, particularly Airbnbs. With its thriving tourism industry, booming entertainment scene, and steady influx of visitors year-round, the demand for vacation rentals continues to rise. Whether you’re a local investor or someone looking to expand your portfolio from out-of-state, securing the right loan for an Airbnb in Nashville is a crucial step in maximizing your investment potential.

Unlike traditional home financing, obtaining a mortgage for an Airbnb property comes with unique considerations. Factors such as occupancy rules, loan types, and lender assessments based on projected rental income play a significant role in securing optimal financing. This guide—powered by Shop Rates, Nashville’s premier mortgage lender—provides a comprehensive breakdown of loan options, eligibility requirements, and expert strategies for financing your short-term rental property in Music City.

Understanding the Nashville Airbnb Investment Landscape

Before diving into the financial aspects, investors need a firm grasp of the Airbnb market dynamics in Nashville. The city’s appeal lies in its thriving tourism industry, bringing millions of visitors annually for events, festivals, concerts, and business engagements. As a result, Airbnb properties generate substantial income—especially in high-demand neighborhoods like Downtown Nashville, East Nashville, The Gulch, and 12 South.

However, local regulations impact short-term rental investments. In Nashville:

- Owner-occupied STRs: Homeowners living on the premises can legally rent out part of their property on Airbnb.

- Non-owner-occupied STRs: Properties that are fully dedicated to Airbnb rentals require specific zoning approvals.

- Permit requirements: Investors must adhere to Metro Nashville’s permit laws, including occupancy limits and taxation guidelines.

For investors, understanding these rules is critical when seeking financing, as mortgage lenders assess both the property’s compliance and its profitability potential before approving loans.

Key Loan Options for Purchasing an Airbnb in Nashville (Featuring Insights from Shop Rates)

Shop Rates specializes in investment property financing, offering a variety of tailored mortgage solutions for Airbnb investors. These include:

1. Conventional Investment Property Loans

Ideal for borrowers with strong credit profiles and financial reserves, these loans come with competitive interest rates and fixed terms. Key features:

- Minimum down payment: Typically 20-25%.

- Credit score requirement: 660+ preferred.

- Fixed and adjustable-rate options available.

- Debt-to-income (DTI) ratio limitations apply.

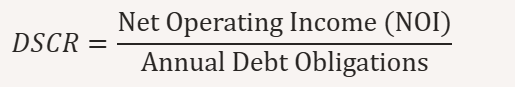

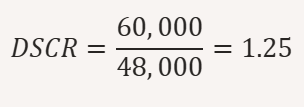

2. Debt-Service Coverage Ratio (DSCR) Loans

Designed specifically for real estate investors, DSCR loans evaluate the rental income potential of the property rather than personal income. Benefits include:

- No personal income verification.

- Loan approval based on projected Airbnb earnings.

- Higher flexibility for borrowers with non-traditional income sources.

3. Portfolio Loans

For seasoned investors or buyers purchasing multiple properties, portfolio loans provide unique flexibility, allowing financing under customized terms. Ideal for those expanding Airbnb holdings in multiple Nashville neighborhoods.

4. Non-Owner-Occupied Mortgages

For buyers financing Airbnb properties without living on-site, non-owner-occupied loans require careful lender selection. Shop Rates specializes in navigating these mortgage structures, ensuring investors receive favorable terms tailored to short-term rental properties.

5. Cash-Out Refinance for Airbnb Properties

Existing Nashville property owners can leverage home equity by refinancing into Airbnb investment loans, unlocking additional cash flow for expansions or upgrades.

How Lenders Assess Airbnb Loan Applications in Nashville

Securing a loan for an Airbnb property isn’t the same as applying for a traditional residential mortgage. Lenders evaluate multiple factors, including:

1. Income Potential and DSCR

Instead of solely looking at W-2 income or tax returns, lenders assess the expected revenue an Airbnb property can generate. Shop Rates utilizes expert market insights to estimate income potential based on:

- Historical Airbnb rental data.

- Local occupancy rates and seasonal demand.

- Comparable properties in the area.

2. Down Payment & Credit Score Requirements

Investment properties generally require higher down payments than primary residences. For Airbnb financing:

- Conventional loans: 20-25% down.

- DSCR loans: 15-20% down.

- Portfolio loans: Customizable based on financial strength.

Additionally, a credit score of at least 660+ is beneficial for securing optimal rates.

Maximizing Your Investment: Why Choose a Local Nashville Lender Like Shop Rates for Your Airbnb Loan

When securing financing for an Airbnb property in Nashville, working with a local lender like Shop Rates offers distinct advantages. Unlike national banks or generic lenders, Shop Rates specializes in short-term rental financing and understands the intricacies of Nashville’s regulations, housing trends, and investment potential.

Benefits of Choosing Shop Rates

- Expertise in Airbnb Financing Shop Rates has extensive experience funding Nashville’s short-term rental market, offering loan programs tailored to Airbnb investors.

- Knowledge of Local Regulations Metro Nashville enforces strict permit laws on Airbnb rentals, and Shop Rates ensures buyers secure compliant financing aligned with city requirements.

- Personalized Lending Solutions Unlike one-size-fits-all banks, Shop Rates customizes mortgage structures based on investment goals, income projections, and property type.

- Faster Loan Processing & Approvals Shop Rates expedites approvals by using local property market data, helping investors close deals quickly in Nashville’s fast-moving real estate environment.

- Direct Access to Loan Officers Investors receive one-on-one guidance from dedicated mortgage professionals who understand Nashville’s unique Airbnb financing landscape.

Step-by-Step Guide to Securing an Airbnb Loan in Nashville with Shop Rates

Step 1: Define Your Investment Strategy

Before applying for a loan, investors should outline their Airbnb ownership goals:

- Will the property be owner-occupied or non-owner-occupied?

- What income do you expect from Airbnb rentals?

- Are you purchasing a new home or refinancing an existing property?

Step 2: Select the Best Loan Option

Investors should compare loan programs with Shop Rates based on:

- Interest rates & terms (fixed vs. adjustable).

- Eligibility requirements (DSCR vs. conventional mortgage).

- Down payment & credit score criteria.

Step 3: Gather Financial Documents

To accelerate approval, investors must provide:

- Personal financial statements (credit history, bank records).

- Property details (rental forecasts, Airbnb income projections).

- Permit verification (proof of compliance with Nashville laws).

Step 4: Submit Loan Application

Once documents are ready, Shop Rates assists investors through:

- Loan application filing.

- Property underwriting & financial assessment.

- Approval timeline estimates.

Step 5: Finalize Your Airbnb Loan & Close the Deal

After loan approval, investors complete:

- Mortgage contract signing.

- Funds disbursement for property purchase.

- Final compliance checks for Airbnb rental readiness.

Refinancing Your Existing Nashville Property into an Airbnb Loan: Opportunities and Considerations

Why Investors Choose Airbnb Refinancing

For property owners already holding real estate in Nashville, refinancing into an Airbnb investment loan unlocks valuable cash flow. Key advantages include:

- Accessing equity to reinvest in renovations or expansions.

- Reducing mortgage rates for better loan terms.

- Reallocating loan structures to match Airbnb profitability models.

Best Refinancing Strategies for Nashville Airbnb Investors

Shop Rates provides tailored refinancing options, including:

- Cash-Out Refinancing: Pulling out equity for upgrades or additional investments.

- Debt Consolidation: Combining multiple loans into a streamlined financing plan.

- Rate Reduction Refinancing: Adjusting mortgage terms for lower interest payments.

- Airbnb-Specific DSCR Refinance: Converting traditional mortgages into income-based loan models.

Common Pitfalls to Avoid When Financing Your Nashville Airbnb (Expert Advice from Shop Rates)

Mistake #1: Ignoring Nashville’s Short-Term Rental Regulations

Some investors overlook Nashville’s strict STR rules, leading to permit denials or legal setbacks. Smart financing with Shop Rates ensures compliant loan approvals.

Mistake #2: Choosing the Wrong Loan Type

Selecting traditional mortgages instead of DSCR loans can limit investors’ eligibility. Shop Rates helps investors pick the best financing match for Airbnb rentals.

Mistake #3: Underestimating Property Expenses

Investors should budget for:

- Maintenance costs (cleaning, furnishing, utilities).

- Taxation requirements (Nashville’s short-term rental taxes).

- Seasonal demand fluctuations affecting income stability.

Mistake #4: Not Partnering with a Local Expert

National lenders often lack experience with Nashville’s unique Airbnb financing landscape. Partnering with Shop Rates ensures optimal mortgage structuring and guidance.

FAQs: Getting a Loan for Your Nashville Airbnb – Answered by Shop Rates

Q: What are the specific loan options available for purchasing an Airbnb in Nashville, Tennessee?

Shop Rates offers DSCR loans, conventional investment mortgages, portfolio loans, non-owner-occupied loans, and cash-out refinancing tailored for Airbnb investors.

Q: How do lenders assess the income potential of an Airbnb property when considering a loan in Nashville?

Lenders analyze:

- Local Airbnb market data (occupancy rates, rental trends).

- Projected income models based on comparable listings.

- Debt-Service Coverage Ratios (DSCR) for approval viability.

Q: What are the typical down payment and credit score requirements for an Airbnb loan in Nashville?

- DSCR loans: Minimum 15-20% down with 640+ credit score.

- Conventional investment loans: 20-25% down with 660+ credit score.

- Portfolio loans: Customized terms based on investment profile.

Q: Can I use a traditional mortgage to finance an Airbnb in Nashville, and what are the limitations?

Traditional mortgages have occupancy restrictions and may disqualify short-term rental properties unless structured for investment use. DSCR or non-owner-occupied loans are often better options. There are also hard money loans available.

Q: How can Shop Rates in Nashville help me secure financing for my Airbnb investment?

As Nashville’s trusted mortgage lender, Shop Rates provides:

- Airbnb-specific mortgage options.

- Local expertise in STR permit compliance.

- Fast-tracked loan approvals for investors.

Q: Can I refinance my existing Nashville property into an Airbnb loan?

Yes, Shop Rates specializes in cash-out refinancing, Airbnb DSCR mortgage restructuring, and rate-adjusted loan conversions for short-term rental properties.

Current Trends in Airbnb Financing in the Nashville Real Estate Market

The Nashville real estate market continues to evolve, particularly in the short-term rental space. Investors looking to finance Airbnb properties must consider key industry trends that impact lending decisions.

Trend #1: Increasing Demand for Short-Term Rentals

Nashville remains a top destination for tourists, corporate travelers, and event-goers, leading to high occupancy rates for Airbnb properties. This demand encourages lenders to offer investment-friendly mortgage solutions.

Trend #2: Stricter Airbnb Regulations Impacting Financing

Recent regulatory changes in Metro Nashville require Airbnb investors to carefully structure loan applications to ensure compliance. Shop Rates assists investors in aligning financing strategies with legal requirements.

Trend #3: Shift Toward DSCR Loans Over Traditional Mortgages

Due to income-based underwriting, DSCR loans have become the preferred financing method for Nashville Airbnb investors. Lenders assess rental profitability rather than personal earnings, making DSCR loans more accessible for real estate entrepreneurs.

Trend #4: Increasing Interest in Refinancing Strategies

Existing Airbnb hosts are refinancing properties to:

- Lower mortgage rates and maximize profits.

- Leverage equity for additional Airbnb investments.

- Restructure loans to align with short-term rental business models.

Final Expert Strategies for Securing the Best Loan for an Airbnb in Nashville

Investors can optimize their Airbnb financing with these top expert strategies from Shop Rates:

1. Build a Strong Financial Profile

Lenders favor investors with:

- High credit scores (660+) for competitive interest rates.

- Stable rental projections showing consistent Airbnb income.

- Adequate reserves to cover down payments & property costs.

2. Work with a Local Lender Specializing in Airbnbs

A local mortgage lender like Shop Rates provides:

- Tailored loan solutions for Nashville’s unique Airbnb market.

- Faster approvals based on local knowledge.

- Guidance in meeting Nashville’s STR permit requirements.

3. Consider DSCR Loans for Simplified Underwriting

Traditional mortgages require income verification that may not align with investment goals. DSCR loans skip personal income checks, allowing Airbnb investors to qualify based on projected rental revenue.

4. Use Cash-Out Refinancing to Expand Your Investment Portfolio

Existing property owners can convert home equity into Airbnb investment funds by refinancing their mortgage with Shop Rates.

5. Avoid Common Airbnb Financing Pitfalls

Investors should steer clear of:

- Overleveraging funds without accounting for market fluctuations.

- Ignoring local zoning laws that affect Airbnb rental eligibility.

- Choosing the wrong loan type that restricts STR investment flexibility.

Final Call to Action: Secure Your Nashville Airbnb Loan Today with Shop Rates

Financing an Airbnb in Nashville requires strategic mortgage planning and expert lender support. Shop Rates specializes in Airbnb loans tailored to investors, ensuring fast approvals, competitive rates, and customized financing solutions.

📞 Contact Shop Rates Today

Ready to finance your Nashville Airbnb venture?

Take the next step in securing profitable Airbnb financing—Shop Rates is your trusted Nashville mortgage partner for investment success!